Payroll tax formula

Household Payroll And Nanny Taxes Done Easy. Ad Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place.

Federal Withholding Calculator Online 59 Off Www Ingeniovirtual Com

Multiple steps are involved in the computation of Payroll Tax as enumerated below.

. For the 2020 tax year employers and employees both pay 62 of the employees wages toward Social Security the total contributions must equal 124. Ad Fast Easy Accurate Payroll Tax Systems With ADP. Find Fresh Content Updated Daily For Formula to calculate payroll taxes.

This guide has the formulas you need to determine federal provincial except Quebec and territorial income taxes Canada Pension Plan CPP contributions and. Payroll period details including the frequency of your pay periods weekly biweekly or monthly and the amount of time for that particular period The gross pay amount. Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later.

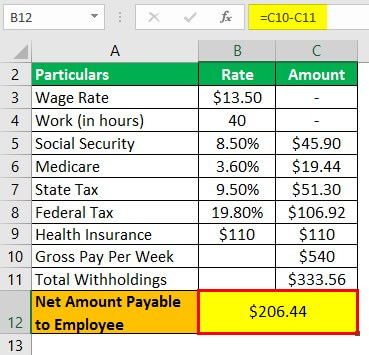

Now onto calculating payroll taxes for employers. Employer FICA Tax Liability Total 11475 9180 15300. 62 of an employees gross pay goes to Social Security tax 145 of an employees gross wages goes to Medicare tax In total 765 of an employees gross wages will go toward the.

The payroll tax is based on the wage or salary of the employee. Employee payroll calculation in Ethiopia using 2021 latest tax rates. Examples of calculating salary income tax cost sharing pension and other deductions to find the.

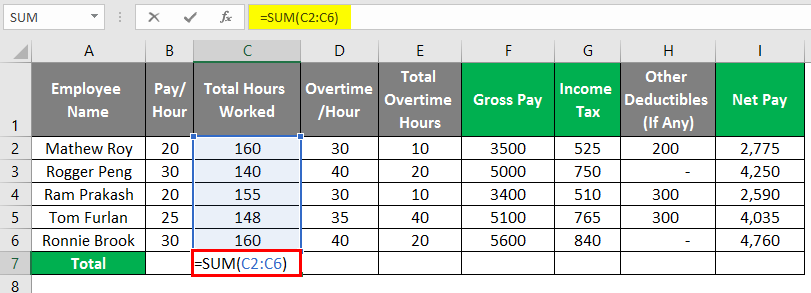

Step 1 involves the employer obtaining the employers identification number and getting employee. Which in terms of excel payroll sheet can be formulated under cell G2 as 015F2 Column F contains Gross Pay. You need to match each employees FICA tax liability.

Well Do The Work For You. You earned a net income of 128000. Payroll Seamlessly Integrates With QuickBooks Online.

Self-employment Tax Formula. If you compute payroll manually your employee has submitted a Form W-4 for 2020 or later. Ad Fast Easy Accurate Payroll Tax Systems With ADP.

The payroll tax formula itself is entered into the Formula field of either the Sage-Maintained Payroll Formulas or User-Maintained Payroll Formulas windows. The payroll tax liabilities that are paid by employees are noted below. Social Security Tax The social security tax is set at 62 of an employees wages and is capped at an.

Payroll tax is a tax that an employer withholds and pays on behalf of his employees. Payroll Seamlessly Integrates With QuickBooks Online. Ad CareCom Homepay Can Handle Your Household Payroll And Nanny Tax Obligations.

Net income 153 Example. State Federal and Territorial Income Taxes Listed below are recent bulletins published by the National Finance Center. Learn About Payroll Tax Systems.

Ad CareCom Homepay Can Handle Your Household Payroll And Nanny Tax Obligations. Over 900000 Businesses Utilize Our Fast Easy Payroll. Sign Up Today And Join The Team.

You must therefore remit 19584 to the IRS. The formula for Income Tax therefore becomes as 015 Gross Pay. Ad Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place.

HR and Payroll Tax Formulas US. Over 900000 Businesses Utilize Our Fast Easy Payroll. Well Do The Work For You.

To see examples of how to set up formulas and tables open the sample company Bellwether Garden Supply. From the File menu select Payroll Formulas then User. Sign Up Today And Join The Team.

Household Payroll And Nanny Taxes Done Easy. 128000 0153 19584. Learn About Payroll Tax Systems.

How To Calculate Payroll Taxes Methods Examples More

How To Calculate Federal Withholding Tax Youtube

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

Paycheck Calculator Take Home Pay Calculator

Payroll In Excel How To Create Payroll In Excel With Steps

How To Calculate 2019 Federal Income Withhold Manually

Payroll Formula Step By Step Calculation With Examples

How To Do Payroll In Excel In 7 Steps Free Template

Payroll Formula Step By Step Calculation With Examples

Payroll Formula Step By Step Calculation With Examples

How To Calculate Federal Income Tax

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Tax Calculator For Employers Gusto

Federal Withholding Calculator Online 59 Off Www Ingeniovirtual Com

Excel Formula Income Tax Bracket Calculation Exceljet

Payroll Tax Deductions Business Queensland

Payroll Tax Deductions Business Queensland